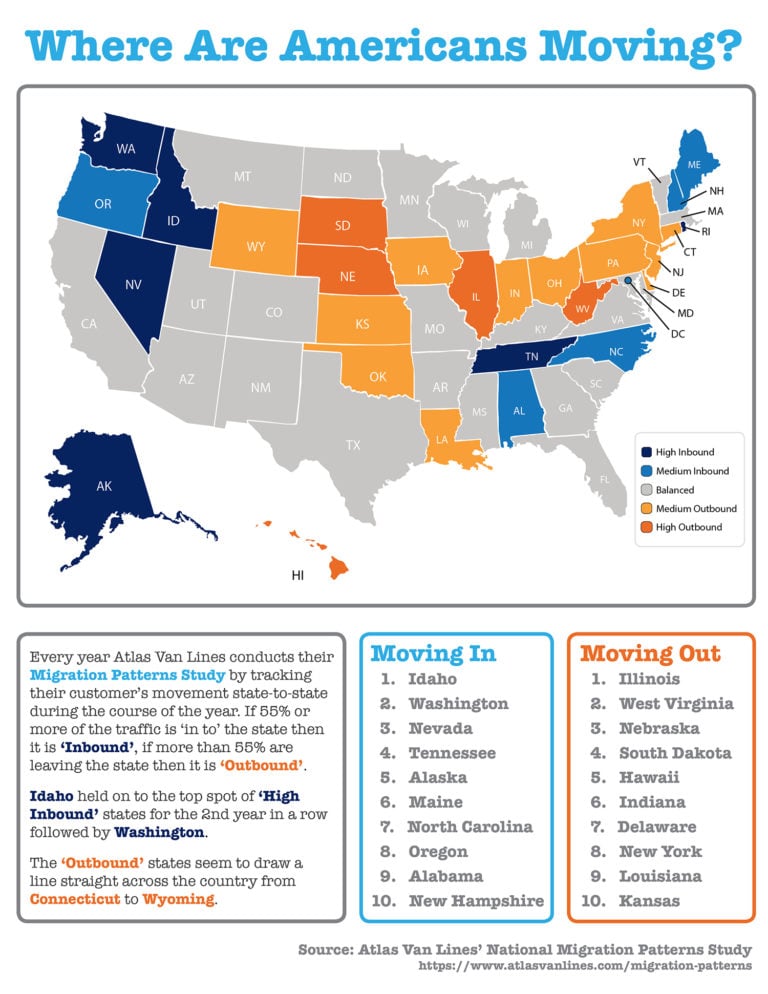

Where Are Americans Moving?

Some Highlights: Atlas Van Lines recently released the results of their annual Migration Patterns Survey in…

Some Highlights: Atlas Van Lines recently released the results of their annual Migration Patterns Survey in…

Every month, CoreLogic releases its Home Price Insights Report. In that report, they forecast where they…

Americans continue to believe that homeownership is important in achieving the American Dream. A recent survey…

The housing crisis is finally in the rearview mirror as the real estate market moves down…

CoreLogic’s latest Equity Report revealed that “over the past 12 months, 712,000 borrowers moved into positive…

According to recently released data from the National Association of Realtors (NAR), the median amount of…

Over the next five years, home prices are expected to appreciate on average by 3.35% per year…

What truly causes a housing bubble and the inevitable crash? For the best explanation, let’s go…

Here are five reasons listing your home for sale this winter makes sense. 1. Demand Is…